Understanding economic efficiency helps you evaluate market health, firm performance, and resource allocation. Productive efficiency cuts costs; allocative efficiency maximizes value. Together, they drive growth and welfare.

Why should you care about economic efficiency?

You face limited resources and unlimited wants. Every decision involves trade-offs. Economic efficiency shows how well those trade-offs deliver value. You gain insight into pricing, production, and policy outcomes.

Markets that achieve both productive and allocative efficiency grow faster. They serve consumers better and waste fewer inputs. According to Economics Help, productive efficiency occurs at the lowest point of the average cost curve. Allocative efficiency happens when price equals marginal cost (P = MC)Economics Help.org.

What defines productive efficiency?

You reach productive efficiency when goods are produced at the lowest possible cost. Firms use labor, capital, and technology without waste. On a national scale, it means operating on the production possibility frontier (PPF).

A factory that cuts shoe production costs from $50 to $35 by upgrading machinery shows productive efficiency. WallStreetMojo highlights that this efficiency reflects optimal use of inputs like energy, equipment, and labor.

Why does it matter?

- Lower costs → lower prices or higher margins.

- Less waste → more output from the same inputs.

- Competitive advantage → stronger market position.

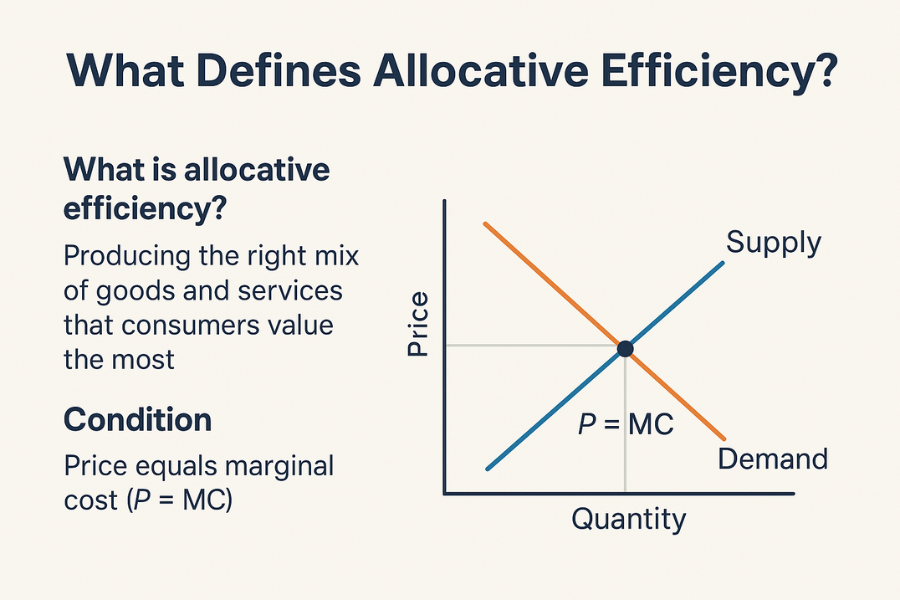

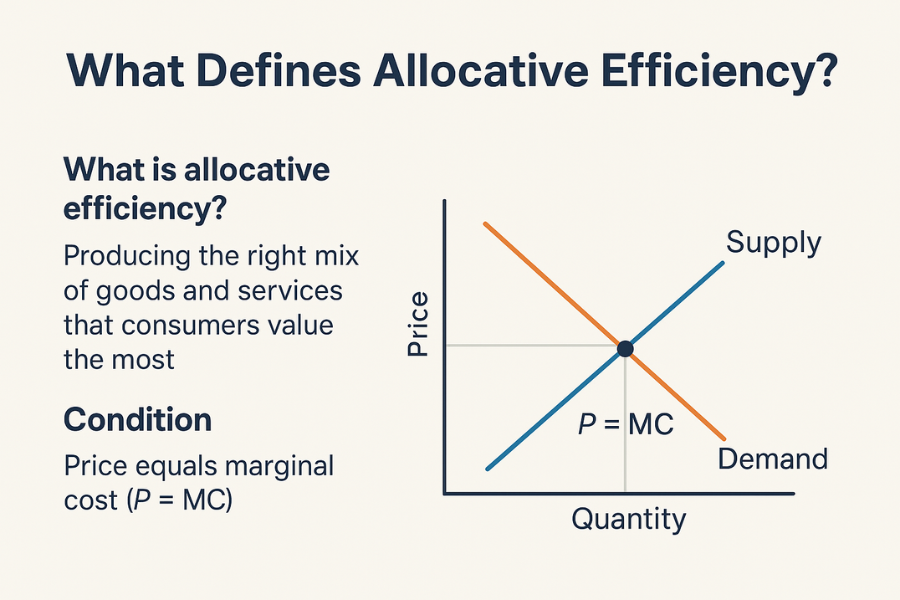

What defines allocative efficiency?

You reach allocative efficiency when the mix of goods matches consumer preferences. Price equals marginal cost. Resources flow to uses that generate the highest welfare.

A store that stocks navy-blue suits due to high demand shows allocative efficiency. Wikipedia notes that when P ≠ MC, resources are misallocated, reducing welfare.

Why does it matter?

- Consumers get what they value.

- Firms avoid producing unwanted goods.

- Markets reflect true demand signals.

How do productive and allocative efficiency compare?

| Feature | Productive Efficiency | Allocative Efficiency |

| Focus | Minimizing production cost | Matching goods to consumer value |

| Goal | Lowest cost for any output | Right mix of goods and services |

| Condition | Lowest point on AC curve | Price = Marginal Cost (P = MC) |

| Scope | Firm-level and economy-wide | Economy-wide and market-specific |

| Dependency | Can exist independently | Often built on productive efficiency |

| Example | Shoes made with fewer inputs | Right number of shoes and shirts produced |

Allocative efficiency depends on productive efficiency. You cannot allocate well if you waste resources during production.

Where do you see efficiency on graphs?

- On a PPF: Points on the curve show productive efficiency. Points inside show waste.

- On supply-demand diagrams: Allocative efficiency occurs where supply equals demand and P = MC.

Monopolies distort this balance. They set prices above marginal cost, causing deadweight loss.

What breaks efficiency?

- Monopolies: P > MC → allocative inefficiency. High costs → productive inefficiency.

- Externalities: Social cost ≠ private cost → misallocation.

- Information asymmetry: Poor decisions → waste and mispricing.

What are the real-world implications?

- A country producing luxury goods at low cost fails allocatively if citizens lack essentials.

- A startup meeting demand at high cost struggles long-term.

- In finance, allocative efficiency means capital flows to productive uses. Productive efficiency means firms use that capital wisely.

What should you remember?

- Productive efficiency = lowest cost.

- Allocative efficiency = highest value.

- P = MC signals allocative efficiency.

- Lowest AC curve point signals productive efficiency.

- Market structure, policy, and technology shape both.

Final Thought

You operate in a world where every resource counts. Productive efficiency ensures you minimize cost. Allocative efficiency ensures you maximize value. Together, they define how well markets serve society. Firms that master both grow faster. Policies that support both improve welfare. Consumers benefit when prices reflect true value and production avoids waste.

Markets fail when monopolies distort prices or when externalities misguide resource use. Efficiency isn’t just theory — it’s the backbone of smart decisions, competitive strategy, and sustainable growth.

FAQs

What is the main difference between allocative and productive efficiency?

Allocative efficiency focuses on producing the right goods. Productive efficiency focuses on producing them at the lowest cost.

Why does P = MC matter in allocative efficiency?

It shows that the value consumers place on a good equals the cost of producing it — a key condition for optimal resource allocation.

Can a firm be productively efficient but allocatively inefficient?

Yes. A firm may produce at low cost but fail to meet consumer demand. Example: making luxury cars when people need affordable transport.

How does the production possibility frontier (PPF) relate to efficiency?

Points on the PPF show productive efficiency. Points inside the curve show inefficiency due to wasted resources.

What causes allocative inefficiency in markets?

Monopolies, externalities, and poor information flow distort prices and demand signals, leading to misallocation.

Why should investors care about economic efficiency?

Efficient firms use capital wisely. Efficient markets allocate capital to its best use, boosting returns and reducing risk.

How do policymakers use efficiency metrics?

They assess whether resources are used effectively and whether markets deliver goods that improve societal welfare.

“QuickFast — Smart insights, fast growth. From tech to travel, business to lifestyle, we give you ideas that matter — and help you act on them.”