A managed investment trust is a unit trust that pools your money under a trustee and a professional manager. You gain access to passive income assets like shares, property, and fixed‑income. You own units, not the assets. You receive distributions that retain income character. You target diversification and tax efficiency. You want clarity on rules, right?

Regulators set strict rules for eligibility and conduct. A trust deed defines the mandate, governance, fees, and distributions. A responsible entity or trustee safeguards assets and enforces compliance. You value strong fiduciary duty and transparent reporting.

How does a managed investment trust work?

You invest cash in units of the trust. A licensed manager allocates capital across the mandate. A trustee oversees custody and compliance. You receive periodic distributions with detailed tax components. You can redeem units or trade listed units on exchanges. You seek liquidity and simple access.

You evaluate three core flows. You put in capital via subscriptions. You receive income via distributions. You exit via redemptions or market sales. You ask about unit pricing and valuation frequency. You need clear rules on cut‑off times and cost base adjustments.

What are the legal and tax rules in key markets?

You encounter regional frameworks that use similar trust mechanics and passive income focus. Australia recognizes MIT and AMIT frameworks under ATO guidance. An Australian resident trustee, widely held status, and passive income tests set core eligibility. AMIT status improves income attribution and cost base handling. You note withholding on “fund payments” for non‑residents under clear rate tables. You ask about the widely held test thresholds and practical examples.

Canada uses mutual fund trusts with flow‑through tax under the Income Tax Act. Provincial securities commissions regulate offerings, disclosure, and investor protection. T3 slips report income character for investors. You check how return of capital affects cost base at sale.

The United States uses REIT and RIC regimes for passthrough. The United Kingdom uses Investment Trusts and REITs under HMRC rules. You confirm distribution tests and asset composition rules. You ask about cross‑border withholding on dividends and interest.

Reference points: ATO guidance on MIT and AMIT rules; provincial securities commissions for Canada; IRS and HMRC rules for REIT and investment trust regimes.

What types of managed investment trusts exist?

You choose structures that match goals and risk. You want clarity on scope and liquidity.

- Equity MITs: Focus on listed shares for dividends and growth. You assess sector mix and factor tilts.

- Fixed‑income MITs: Hold government and corporate bonds for coupon income. You watch duration and credit quality.

- Property or real‑asset MITs: Own income‑producing real estate or infrastructure. You track occupancy, lease tenor, and cap rates.

- ETF trust structures: Track indexes with intraday trading and low fees. You watch tracking differences and spreads.

- Multi‑asset MITs: Blend equities, bonds, and alternatives for balanced outcomes. You check rebalancing rules and drawdown controls.

Market facts: Global ETF assets sit in multi‑trillion USD territory as of recent industry surveys. REIT regimes in major markets require high distribution ratios that support income profiles.

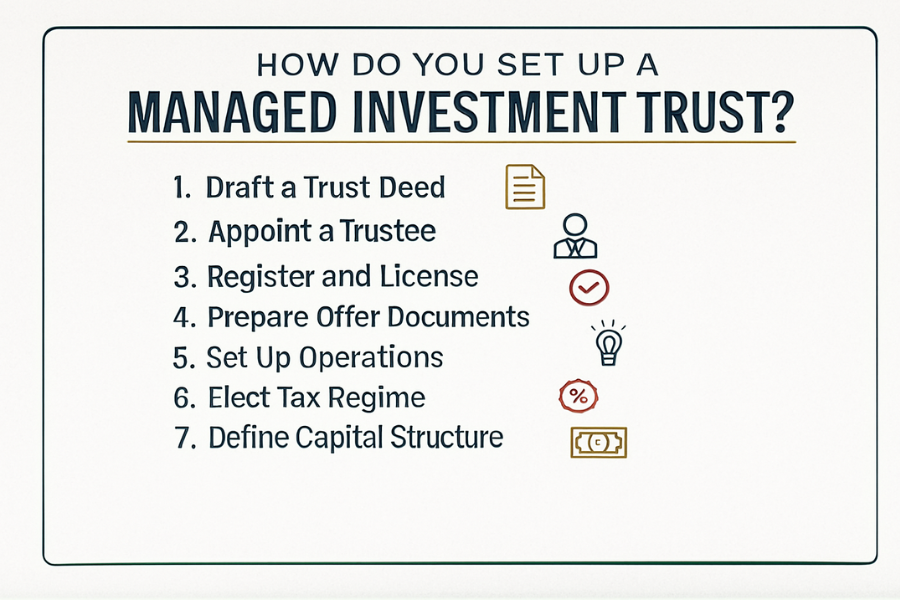

How do you set up a managed investment trust?

You follow a precise build sequence. You ask experts for legal and tax certainty.

- Trust deed: Define mandate, eligible assets, concentration limits, valuation, distributions, and unit classes.

- Trustee and responsible entity: Appoint qualified fiduciaries with robust compliance and capital adequacy.

- Licensing and scheme registration: Secure manager licenses and register the scheme where required. You implement KYC and AML.

- Offer documents: Draft a prospectus or PDS with risks, fees, tax, and liquidity terms. You set a clear dealing calendar.

- Operations stack: Retain fund admin, custody, audit, and tax agents. You enforce NAV controls and distribution workflows.

- Tax elections and withholding: Make regime elections such as AMIT. You set non‑resident withholding processes and investor reporting.

- Capital structure: Define retail and wholesale classes, accumulation or distribution units, and swing pricing where appropriate.

Reference points: ATO AMIT guidance for attribution and cost base rules; securities regulators for offer documents and licensing; audit standards for NAV control frameworks.

How do you evaluate and invest in a managed investment trust?

You test fit, quality, and cost. You want a repeatable process and transparent data.

- Strategy fit: Align mandate with your goals and risk. You check benchmarks and risk budgets.

- Manager quality: Review team tenure, process discipline, and net performance versus benchmarks. You prefer strong risk controls.

- Fee structure: Compare management, performance, admin, and custody fees. You verify hurdles and high‑water marks.

- Portfolio transparency: Look for holdings reports, concentration limits, derivatives policy, and liquidity stress tests.

- Tax handling: Inspect distribution character, AMIT status, cost base guidance, and cross‑border withholding.

- Liquidity and dealing: Confirm redemption terms, notice periods, and exchange trading metrics like average volume and bid‑ask spreads.

Useful baselines: Manager fee medians cluster near low single‑digit percentages for active funds. Bid‑ask spreads on large ETFs often sit near a few basis points in liquid markets.

What are the benefits and risks?

You weigh upside against exposure. You want clear trade‑offs.

- Benefits:

- Diversification: You gain broad exposure across assets and sectors.

- Tax efficiency: You receive flow‑through income with preserved character under trust rules.

- Professional oversight: You access institutional research and risk controls.

- Access and liquidity: You use daily pricing or exchange trading for simple entry and exit.

- Risks:

- Market and sector risk: You face price swings from equity, rates, credit, and property cycles.

- Fee drag: You see lower net returns when fees exceed value add.

- Tax complexity: You manage income character, withholding, and cost base changes.

- Governance exposure: You depend on trustee and manager quality.

- Liquidity mismatch: You risk stress when open‑ended trusts hold illiquid assets.

Reference points: Fee and performance dispersion studies show many active funds fail to beat benchmarks net of fees over long windows. REIT sector drawdowns correlate with rate shocks and property fundamentals.

FAQs

- What is the purpose of an investment trust?

You pool capital for diversified exposure under professional control, clear rules, and transparent reporting.

- Who is eligible for MIT trust?

You qualify the trust under local rules such as Australian MIT or AMIT criteria. You invest as retail or wholesale under offer rules and disclosures.

- What is a managed trust?

You rely on a trustee and a manager under a deed and regulator oversight. You receive distributions per stated policy.

- What is an example of a managed investment scheme?

You invest in an open‑ended unit trust that holds ASX shares, prices daily, and offers a PDS under a responsible entity.

Quick comparison table for common trust structures

| Structure | Legal form | Income focus | Liquidity | Typical tax path |

| MIT (Australia) | Unit trust | Passive income | Daily pricing or listed | Flow‑through, AMIT attribution, non‑resident withholding |

| Mutual fund trust (Canada) | Trust | Mixed income | Daily pricing | Flow‑through, character retention, T3 slips |

| ETF trust | Often a trust | Index exposure | Intraday trading | Jurisdiction rules, low fee focus |

| REIT | Trust or company | Real estate income | Listed units or shares | Preferential rules under distribution tests |

Direct answers

- Managed investment trust: A professionally managed unit trust that pools public investors’ money into passive income assets, distributing income with flow‑through tax treatment and operating under strict legal and regulatory rules.

Swift insights. Smarter decisions QuickFast